How to fill out an error-free bank check? Example and step-by-step guide. It is not apparent to be able to fill out a review without errors. Especially for those who do it for the first time, or when it comes to very high figures, it is advisable to recognize if a bank check has been completed in the right way to avoid the risk of being canceled due to a slight carelessness. An example, in this case, is handy. In this article, we read about How to fill out a cheque?

The saver, provided with a notepad, is asked to fill in his check himself, not as happens with the cashier’s check, which the bank instead fills in.

Below, Money. It presents a step-by-step guide on how to do it, explaining in detail the meaning and use of the fields to be filled in, together with some examples on how to write information on your check.

How to fill out a check

First of all, we clarify that a check is a tool used to pay a given sum by a debtor, who must have a current account.

The information you need to have to fill out a check are:

account holder name (your name);

amount of the bill;

beneficiary name.

For an amount exceeding € 1,000, the “Non-Transferable” clause must be specified on the check to be completed. For smaller amounts, however, the review can be both transferable and non-transferable.

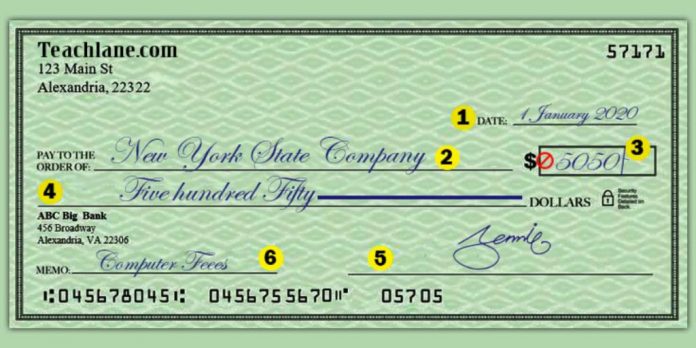

Example on how to fill out a check

Each number shown in the infographic corresponds, below, to the point that explains and clarifies how to fill out a check without errors.

1) Place to fill out a cheque

At the top, in the “Place” field, you must enter the city’s name in which the check is drawn up. It seems unnecessary and redundant information, but in reality, filling out a bank check directly affects the waiting time for its presentation.

If the place of issue of the check corresponds to the site where the bank that issued the checkbook is based, then we are in the presence of a review “on the square,” and its presentation (collection) is possible within eight days from the date reported. If, on the other hand, the two places do not have correspondence, the time for presentation increases up to 15 days, and the check is said: “out of place.”

2) Date to fill out a cheque

This field must be completed by entering the date from which the check’s validity begins, presumably the same as when it was filled out. Warning: according to Italian law, filling out post-dated reviews is illegal.

The only exception is in case of need to send a completed check when a postdating of no more than four days is allowed to allow the bill to be delivered to the beneficiary, who will have all the time to make his presentation. The date is significant because it defines the days available to the heir to cash the check: 8 days if the review is on the square and 15 days if the statement is out of the yard. Whoever issues the check can ask the bank to cancel the payment.

3) Amount in numbers to fill out a cheque

The check amount should be written in numbers in this space, i.e., how much money the person filling out the check must transfer to the beneficiary.

The field has a comma and two small boxes on the right. When filling in, the whole numbers must be entered on the left (in our example, 172), while the cents must be entered in the two boxes (in our case, 00 because the figure is round).

4) Amount in words

This is the part that generally gives you the most trouble filling out a check. The amount to be transferred in letters must be entered in this field (we must share 172 euros, so we write ” one hundred and seventy two “).

Once the decimal amount has been written, we must draw the symbol “/” (without quotation marks) and enter the number of hundredths in digits (in our example, / 00). Therefore, the complete compilation of this field becomes “ one hundred and seventy two / 00 ”. If, on the other hand, our check has an amount of € 400.50, then we should write “four hundred / 50”.

5) Beneficiary name

Here we enter the name and surname of the person or company to whom the check is addressed. And who therefore has the right to cash the review once completed. It is possible not to specify the beneficiary’s name: in this case, the field is left blank. And the check is “bearer” and can be cashed by anyone who comes to the bank to collect it. There is also the possibility of indicating yourself. As the beneficiary of a check by writing “to myself” in this field.

When the name of the beneficiary is specified, the check is automatically non-transferable. The beneficiary can only cash it. At the same time, the transferable one can be paid to another person. Through the operation known as an endorsement, even if the name of another beneficiary.

6) Signature

Here, the signature of the person issuing the check must be entered, i.e. The current account holder who fills out the bill. The signature is required to make the statement valid and must be the same. One deposited when opening an account with your bank. If the signature is different, the check is void.

How to fill in the check slip

These are the most important parts to know how to fill out a check. However, to make our guide even more complete. Let’s see what the coupon is for, which, once a review has been filled out and torn. Remains attached to our checkbook. The account holder uses the remaining coupon to track. And remember the checks issued with their amounts and the names of the beneficiaries.

Check the date – The same date entered in field 2) must be reported.

In favor of – The name entered in field five must be reported

Amounts – Enter the amount of the check-in numbers as in chapter 3)

Reason – Field absent in filling in the check to be given to the beneficiary. It is valuable information for the account holder to remember the reason for issuing the check.

Also read: how to delete Paypal account