RTGS means ‘Real Time Gross Settlement.’ and NEFT means “National Electronic Funds Transfer.”

What are the differences between RTGS and NEFT?

There are several differences between these two that are listed below.

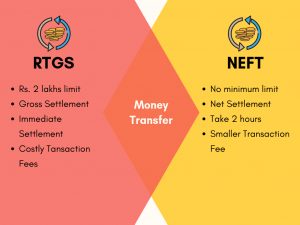

- The minimum permissible amount of RTGS is Rs. 2 lakhs, unlike NEFT, which does not have any minimum limit on remittance.

- There isn’t any upper ceiling on the amount of maximum payment through RTGS, and there is no high limit on the amount of maximum remittance through NEFT.

- The maximum amount of regular or cash-based payment to Nepal via RTGS or the maximum amount of each transaction visa NEFT is restricted to Rs.50,000.

- The timings for all RTGS transactions (excluding Inter Bank Transactions) are 09:00 hrs. to 16:30 hrs. from Monday to Friday and 09:00 hrs. to 13:30 hrs.’ on Saturday. Whereas hourly batches have been introduced for NEFT transactions.08:00 hrs. to 19:00 hrs. from Monday to Friday,08:00 hrs. to 19:00 hrs. On working Saturdays, and no transaction on the 2nd and 4th Saturday.

- As the RTGS base on gross settlement, it carries out promptly. A gross settlement means that it is not associated with other transactions. It is done on a one-to-one basis. NEFT relies on net settlements. Net settlements those transactions that perform in batches. These transactions held till a particular time—net settlements, also known as (DNS) deferred net basis.

- RTGS doesn’t charge any service charges for the inward transaction. However, in outward transactions, some slabs create. For example, a Maximum of Rs. 30/ will charge for each transaction of Rs 2 lakh to Rs 5 lakh. Above Rs 5 lakh will charge Rs.55/- for each transaction.

Beneficiary Accounts

- NEFT doesn’t charge service charges for inward transactions to beneficiary accounts at the destination branches of the bank. However, Outward transactions charge. The slab of charges is here as well. A maximum of Rs 2.50 (plus Service Tax) will deduct up to Rs 10,000. Maximum of Rs 5 (plus Service Tax) will deduct from Rs 10,000 TO Rs 1 lakh. A maximum of Rs 15 (plus Service Tax) will deduct from Rs 1 lakh to Rs 2 lakhs. A maximum of Rs 25 (plus Service Tax) will charge above 2 Lakhs.

- The amount settles immediately by RTGS, whereas it takes two hours for the settlement in NEFT.

The remitting customer has to provide basic information to a bank for starting an RTGS remittance. This includes Amount to remitted, Account number remitting customer’s which will debit, Name of the beneficiary bank and branch, Name of the beneficiary customer, Account number of the beneficiary customer, Sender to receiver information if any, and The IFSC Number of the receiving branch.

Also read: Difference between management and administration.